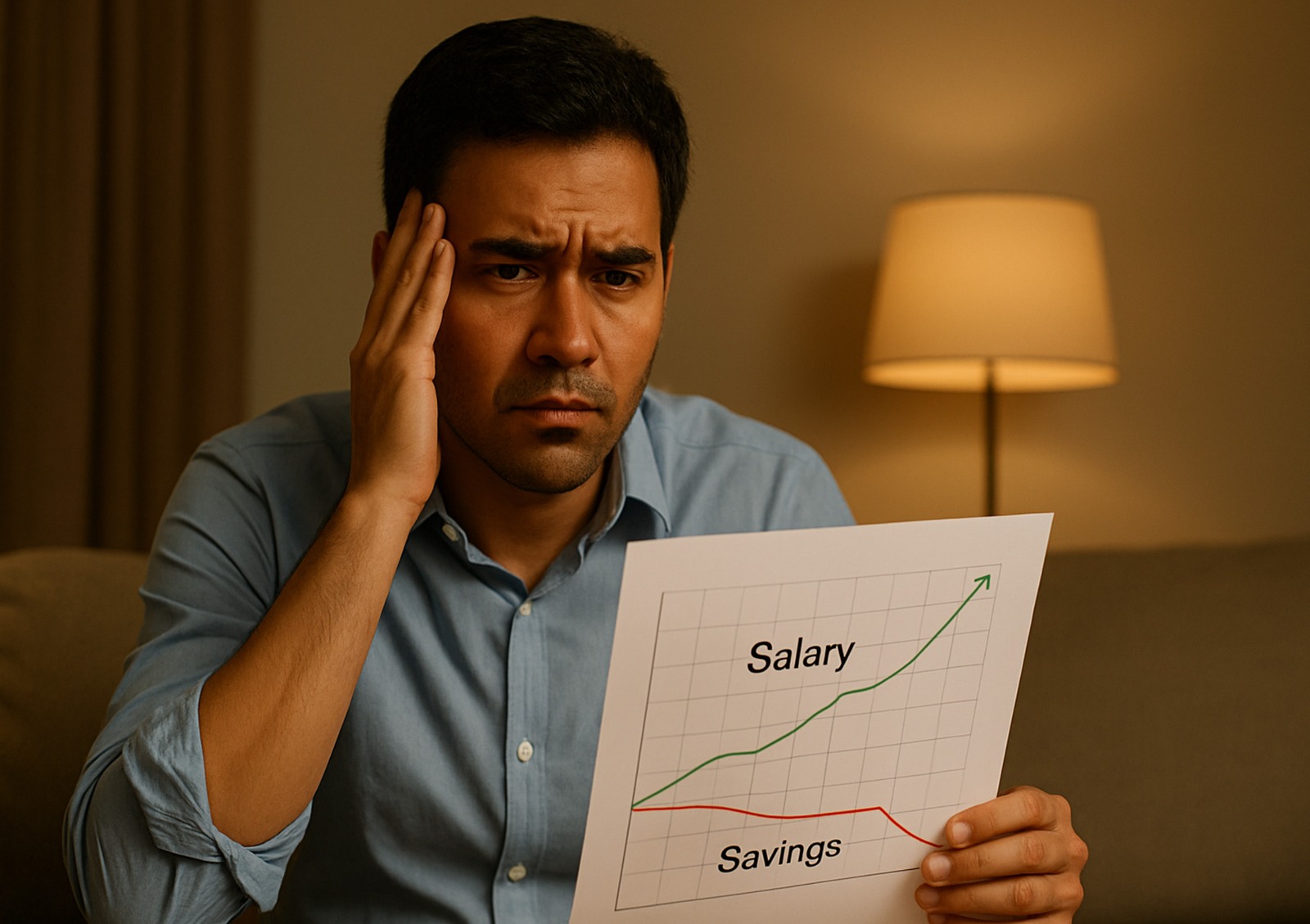

It's a paradox that's becoming increasingly common across urban India: professionals earning more than ever before, yet feeling financially stretched at the end of each month. The salary has doubled, the job title has been upgraded, but somehow the bank balance tells a different story.

Despite impressive packages that would have seemed unimaginable just a few years ago, many working professionals find themselves caught in a peculiar trap. The money flows in, but it flows out just as quickly, leaving little room for the financial security they thought higher earnings would bring.

The culprit behind this modern financial dilemma isn't rising costs alone; it's something far more insidious called lifestyle inflation.

Lifestyle inflation is the unseen wealth killer that makes us believe we deserve something superior as we become richer. Such promotion induces upgrading to an apartment. The reason behind the fancier car is the bonus. The new job will require a wardrobe makeover. Every choice seems logical on its own, but the combination creates a trap of charges, from which even a high-income earner can be imprisoned.

For someone earning ₹20 lakh annually, the take-home salary after taxes and deductions is roughly ₹1.25 lakh per month. In metro cities, a decent apartment consumes ₹40,000, while a car EMI adds another ₹25,000. Monthly household expenses, including groceries, utilities, and dining out, easily reach ₹30,000. Add phone bills, subscriptions, and unexpected social expenses, and barely ₹15,000-20,000 remains for savings.

"That's assuming you resist every temptation," CA Kaushik warns. "Most people don't."

Social media has weaponised lifestyle inflation. Curated feeds showcase endless upgrades, exotic vacations, trendy restaurants, and the latest gadgets. The fear of missing out pushes spending beyond rational limits.

"Everyone seems to be living better than you," observes financial advisor Abhishek Kumar. "That psychological pressure is real and expensive."

The rise of Buy Now, Pay Later schemes and no-cost EMIs has made overspending dangerously convenient. Expensive purchases are disguised as affordable monthly payments, creating an illusion of financial control while building a mountain of debt.

Living paycheck to paycheck despite a healthy income is the first red flag. Using credit cards for groceries or monthly bills, dipping into savings for routine expenses, and constantly juggling EMIs are other danger signals.

Personal loan growth among urban professionals has hit record highs, while delinquencies in BNPL accounts continue rising. The middle class is borrowing to maintain a lifestyle that their actual income can't support.

The solution isn't about living like a monk. It's about conscious spending. Financial experts recommend the 50-30-20 rule: 50% for needs, 30% for wants, and 20% for savings and investments.

The 24-hour rule for big purchases can prevent impulse buying. Limiting EMIs to essential items and tracking expenses can reveal surprising spending patterns.

The middle-class dream in modern India isn't about earning more, it's about keeping more. Because in the end, it's not your salary that builds wealth. It's what you do with it that counts.

Building wealth requires discipline, not just income. The sooner you realise this, the richer you'll become.