Loan Harassment Claims Another Life

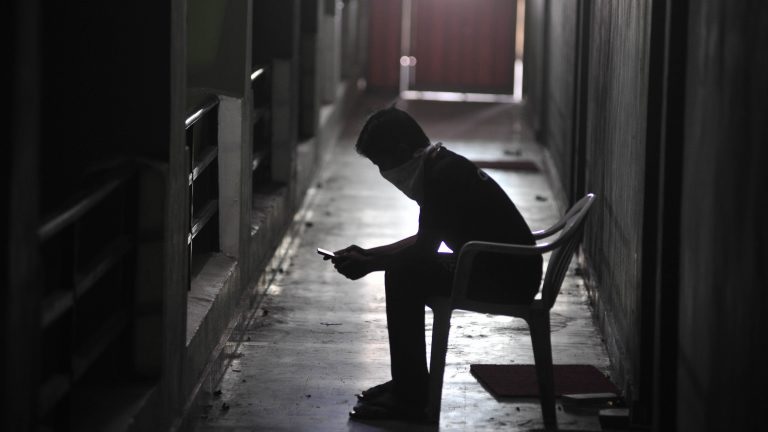

The recent suicide of a Mumbai excise department employee due to loan repayment harassment is a stark reminder of the growing financial and mental health crises in India. This incident underscores the pressing issue of predatory lending practices and the lack of robust mechanisms to protect vulnerable borrowers from undue harassment.

In an era where financial inclusivity is celebrated, unscrupulous lenders have turned this aspiration into a nightmare for many. Despite stringent laws, the enforcement remains weak, leaving borrowers at the mercy of aggressive recovery agents. For government employees, whose salaries are often garnished to repay loans, the pressure to meet steep demands can spiral into a debilitating psychological burden.

While the financial system boasts accessibility, it fails to address the mental toll of repayment cycles. The stigma attached to debt and the absence of institutionalized mental health support exacerbate the problem, often pushing individuals toward irreversible decisions.

The government must address this dual crisis. A two-pronged approach, involving stringent regulation of lending practices and accessible mental health services, is vital. Clear, enforceable penalties for harassment by recovery agents should be coupled with mandatory counseling for borrowers struggling with repayment.

This tragedy should serve as a wake-up call to policymakers and society at large. Loan harassment is not just a financial issue; it is a human rights issue. Until tangible measures are taken, more lives may be lost to a system that prioritizes profit over people.