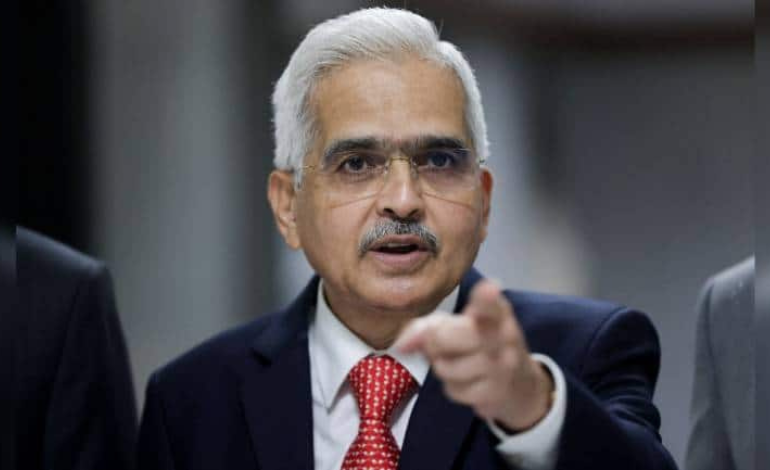

Shaktikanta Das, governor of the Reserve Bank of India (RBI), stated on Wednesday that the debut of the electronic rupee was a significant development in the history of the nation's money and that it will fundamentally alter how people conduct transactions and conduct business.

He stated that the RBI wants to work out all the kinks in the Central Bank Digital Currency (CBDC) before it is introduced. He also stated that by CY 2023, the central bank aims to fully provide digitalized Kisan Credit Card loans.

Das argued that price stability, sustainable growth, and financial stability need not be mutually incompatible in his speech to Indian bankers. He added that withholding the letter the RBI will write to the government for missing its inflation goal, in no way compromises openness.

CBDC is a conventional form of digitally-issued money to the uninitiated. It is digitally-issued legal tender from a central bank. The CBDC used in India is known as "e₹," and because it is a digital version of the rupee, it can be traded one-for-one for fiat money.

“ It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different,” said RBI.

He stated that despite the country's macroeconomic indices and buffers, the Indian economy has continued to expand steadily. India now embodies strength and hope for the rest of the globe.

Regarding inflation, Mr. Das added that domestic inflation rates are still high and that the central bank is closely monitoring them. Market-wide financial conditions have become more tighter, which has increased the dangers to financial stability.