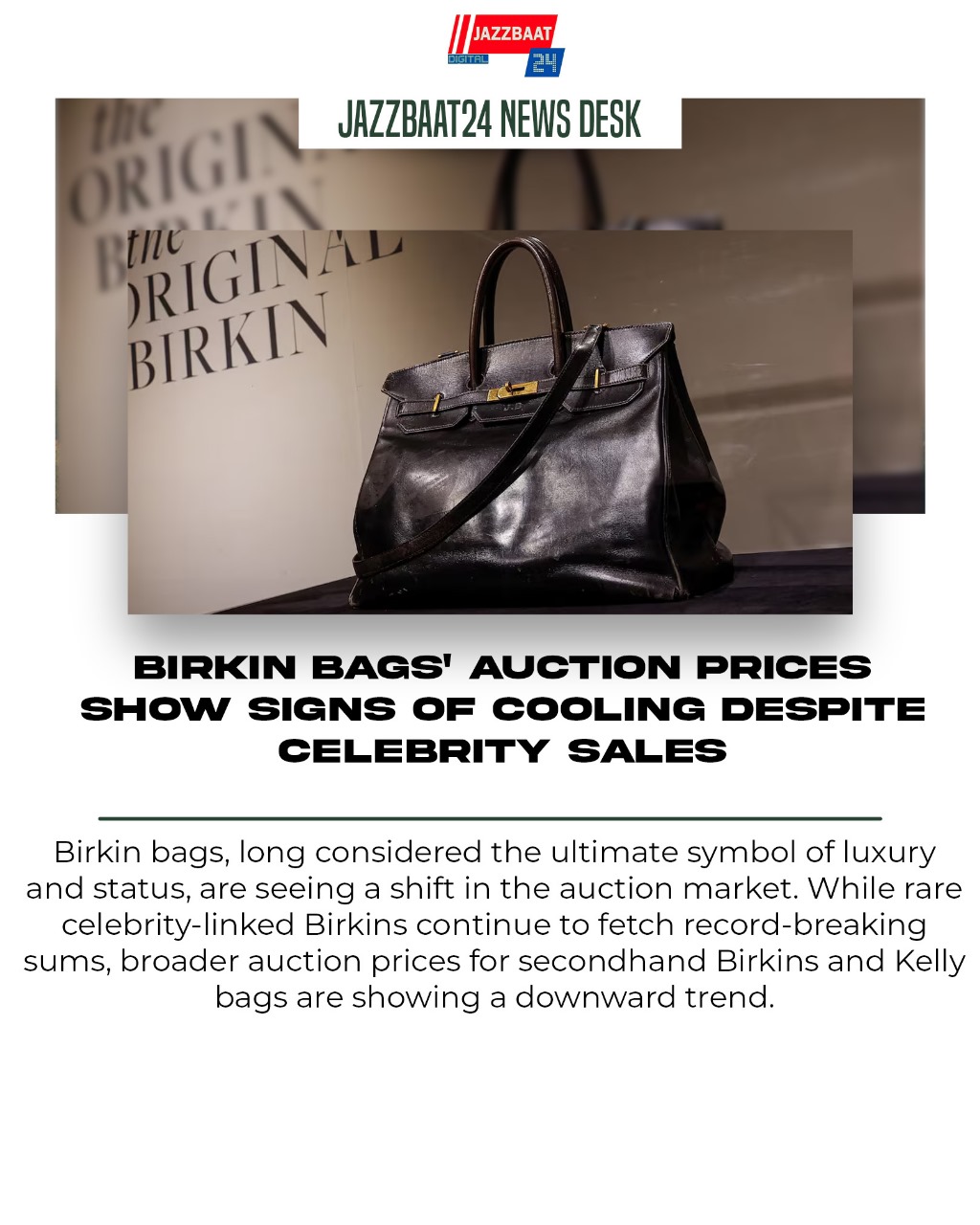

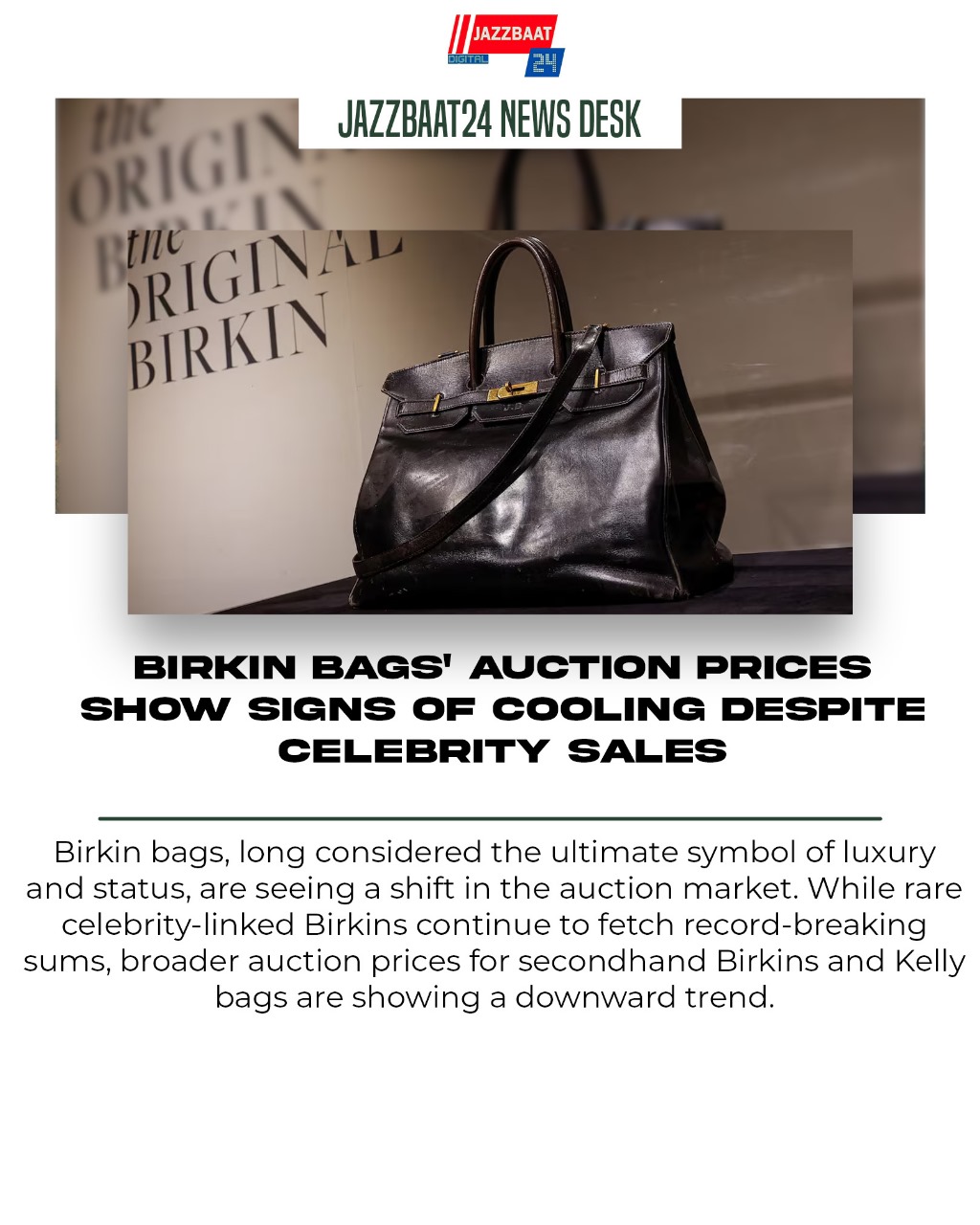

Birkin bags, long considered the ultimate symbol of luxury and status, are seeing a shift in the auction market. While rare celebrity-linked Birkins continue to fetch record-breaking sums, broader auction prices for secondhand Birkins and Kelly bags are showing a downward trend.

Recently, a Jane Birkin-owned Black Box Birkin 40 with palladium hardware sold at Sotheby’s for $2.9 million, far exceeding its estimate of $440,000. Earlier in July, her original Birkin bag fetched an astounding $10 million. These high-profile sales, however, are exceptions rather than the rule.

Data from Bernstein shows that the average resale premium for Birkins and Kellys has declined from 2.2 times the retail price in 2022 to 1.4 times in November 2025. For example, the Birkin Togo 30 now sells at roughly its original retail price, a steep fall from previous years. Analysts attribute this trend to multiple factors, including inflation, a slower job market, and an increase in secondhand supply. The rise of resale platforms has made more Birkins available, putting downward pressure on prices.

Luxury analysts suggest this adjustment reflects a “sobering up” from the post-COVID luxury boom. Despite this, most Birkin and Kelly bags still sell above retail, driven by demand exceeding supply. The prestige of owning a Hermes bag, combined with long waitlists and complex buying rules, continues to sustain interest.

A 2025 report by Rebag indicated Hermes dominated the luxury bag market, with several styles still selling above retail, including Birkins at a premium of 22% over original prices. While the market is normalizing after years of rapid growth, the Birkin’s position at the top of luxury fashion remains unchallenged.

Even with the cooling at auctions, Birkin bags continue to symbolize exclusivity, patience, and wealth, proving that while the market may fluctuate, the allure of the iconic handbag endures.